/ Work

/ About Sheep Dog Designs

Sheep Dog Designs is a small, independent mobile app and web developer based in Adelaide, Australia. Specialising in Apple devices and with a passion for bringing emerging technology to life with great software.

Get in touchFully custom designs from scratch, or build up and iterate from initial concepts or prototypes

Web DesignFull website design, install and configuration; specialising in WordPress and customising themes

Graphic design skills in house for branding, logos, prototypes and custom components

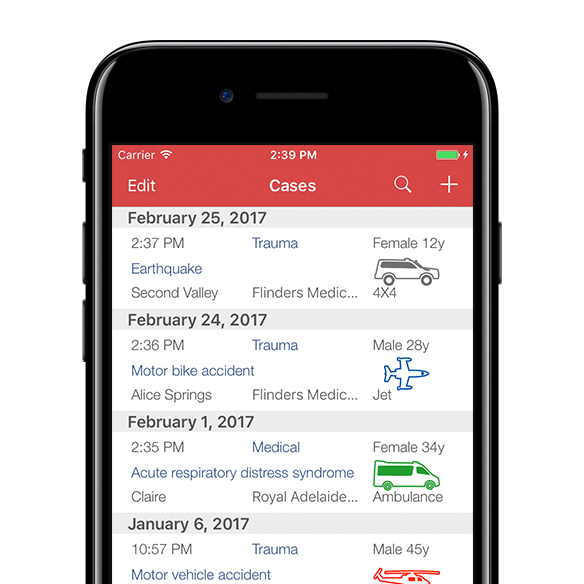

ApplicationsSpecialising in Apple iOS devices, with five years development experience, including with the Apple Watch

We are passionate about solving problems to

transform

digital

solutions

Check our Skills

/ Creativity

/ Contact Us

Have any feedback or feature requests for one of our Apps? Got a project you’re interested in discussing? Get in contact, we’d love to talk.

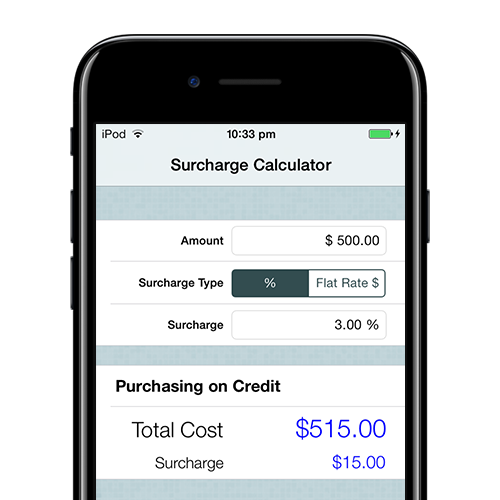

/ Surcharge Calculator Help

- Amount: the price of the item or bill you are considering paying for with your credit card[/list_item]

- Surcharge Type: how the seller is applying a surcharge to the item – either as a percentage of the amount, or as a flat rate (i.e.fixed fee). Most commonly this will be as a percentage, and the calculator will translate this into dollars. If you choose “Flate Rate” then it will calculate what this is as a percentage of the cost.

In addition to the above, on the “Compare Tab”, you also need to enter:

- Interest Rate: the annual interest rate of your bank account where you would purchase the item from if you do not use your credit card. It could be a savings account or line of credit account – either way the result is the same.

- Interest Period: is the number of days that you want to calculate interest for to compare. Normally you would put your “Interest Free Days” from your credit card. It is used to calculate the equivalent interest you would otherwise earn on your savings by leaving the money in your account when purchasing on credit card. You may need to change this depending on your individual circumstances, depending on how your bank calculates and pays your interest

Surcharge = Amount x Surcharge Rate.

The interest shown when purchasing on savings is interest that is lost by not having the money in your savings account for the interest period you entered. If you have a credit card where you get a certain number of days where you are not charged interest (i.e. in Australia many credit cards have ‘up to 55 days interest free’) which covers the maximum time in between when you make a purchase and need to pay off your credit card.

The calculator uses this period to determine how much interest you would earn in your savings account if you pay by credit card and leave the equivalent amount in your bank account to earn interest.

Interest = amount x interest rate applied over the number of days you enter.

This calculator is intended as a useful guide only; you will need to consider your own personal financial circumstances when using this app.

Found an issue with one of our apps, or just not sure how to get what you need out of it? Ask us here, we’d love to help.